Talk to a real estate broker to learn more about how an FHA loan could impact the purchasing prospects in your local market. Not only could it change how a seller perceives your offer, but FHA lending caps could also limit your purchase options. On the other hand, if you can qualify for a conventional loan and live in an area with a competitive housing market, it may be better to forego an FHA loan.

It might also be your only option if your credit score is low or you have a higher debt-to-income ratio. Department of Agriculture (USDA), an FHA mortgage is one of the cheapest ways to finance a house. With the exception of government mortgage programs through the Department of Veterans Affairs (VA) and U.S. If you have relatively little savings, you might have no choice but to take out an FHA loan. Because of these additional inspection requirements, sellers who receive multiple bids may be inclined to accept one from a buyer with conventional financing rather than an FHA loan. FHA loans have specific inspection requirements to confirm a home is worth its price and that it meets certain health and safety standards. Depending on housing prices in your area and the type of home you want to buy, it might be difficult to find a home you like within FHA lending limits. The government also recently reduced the cost of monthly MIP payments by 30 basis points for all FHA borrowers that took out loans after March 20, 2023. The good news is that if you make a down payment of 10% or more, the premium will automatically end after 11 years. You’ll have to pay both an upfront MIP and an annual MIP when you take out an FHA loan.

Otherwise known as MIPs, these are the most significant downside of an FHA loan.

Loans may be available regardless of whether you own the land where the home will be located or plan to live in a mobile home park or manufactured housing community.įHA loans aren’t ideal for everyone, though. The FHA will insure loans for factory-built homes including mobile homes and manufactured homes. To be approved for a conventional loan, you typically need a credit score of at least 620, but you can qualify for an FHA loan with a score as low as 500. Lenders require documentation of your income and employment, but many will accept credit scores far below those required for conventional loans. If your credit score is below 580, you’ll need to put down at least 10%. However, with an FHA loan, your down payment could be as little as 3.5%. With a conventional loan, you may be required to make a 20% down payment. Here are some of the reasons you might want to take out an FHA loan: Like all financial products, there are benefits and drawbacks to FHA loans. There are also higher limits for properties in Alaska, Hawaii, Guam and the Virgin Islands. or San Francisco-you can borrow up to the ceiling. Much of the nation falls at the lower end of that range, but if you’re buying a home in a high cost-of-living area-such as New York City, Washington D.C. In 2023, the FHA loan limit ranges from $472,030 to $1,089,300 for one-unit properties. This amount depends on where you live in the country. There’s also a cap-or limit-on the amount you can borrow with an FHA mortgage. To be eligible for an FHA-backed mortgage, your home must: For instance, some lenders may only approve your application if your credit score is at least 600.įHA loans also have property requirements, and not every house will qualify.

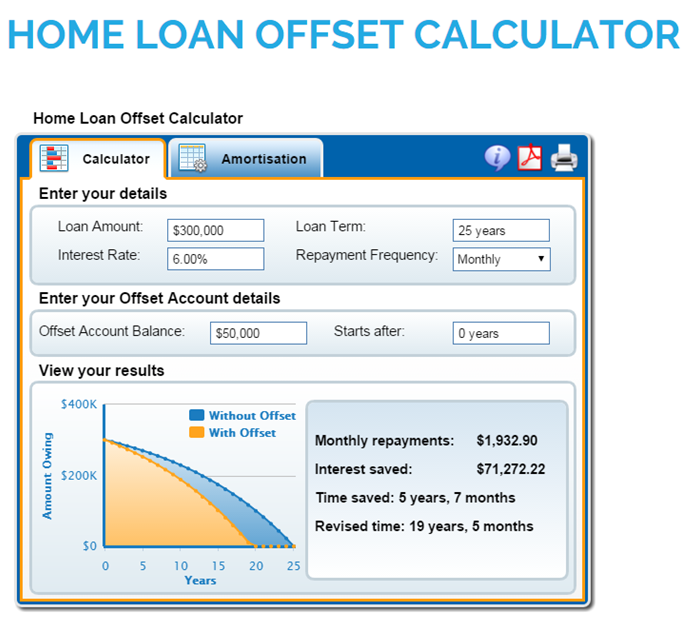

LOAN FINANCE CALCULATOR FREE

These guidelines are FHA minimums, but lenders are free to overlay their requirements for applicants. Applicants can have credit scores as low as 500, although you’ll need a larger down payment if your score is below 580. Down payments can be as little as 3.5% of the purchase price of a property. If you have trouble qualifying for a conventional mortgage, you might find success applying for an FHA loan, which typically have less stringent requirements like: Rather, the government is insuring the lender and promising they won’t be out the money if you default on your payments. It’s worth noting that when we say the FHA insures the loan, that insurance isn’t for you. Instead, lenders who participate in the FHA program are the ones who provide funds to homebuyers with government backing. This government agency guarantees the loan, but it doesn’t actually lend money.

What Is an FHA Loan?Īn FHA loan is a mortgage insured by the Federal Housing Administration. The 52-week high rate for a 30-year FHA loan was 6.64% and the 52-week low was 5.74%. The current average rate for a 30-year FHA loan today is 6.36% compared to the 6.48% average rate a week earlier.

0 kommentar(er)

0 kommentar(er)